Prepare CIMs Fast

Draft banker‑grade CIMs 70% faster—with drivers‑based models and a 200+ buyer universe.

Research & analysis: competitive landscape, market sizing, LBO, comps, positioning.

Examples

Explore common sell‑side tasks. Click to open a live example.

Seller Prep

Process‑ready materials, buyer management, and analytics—tuned for lower mid‑market timelines.

- • Teaser, CIM draft (60–80 slides) with citations

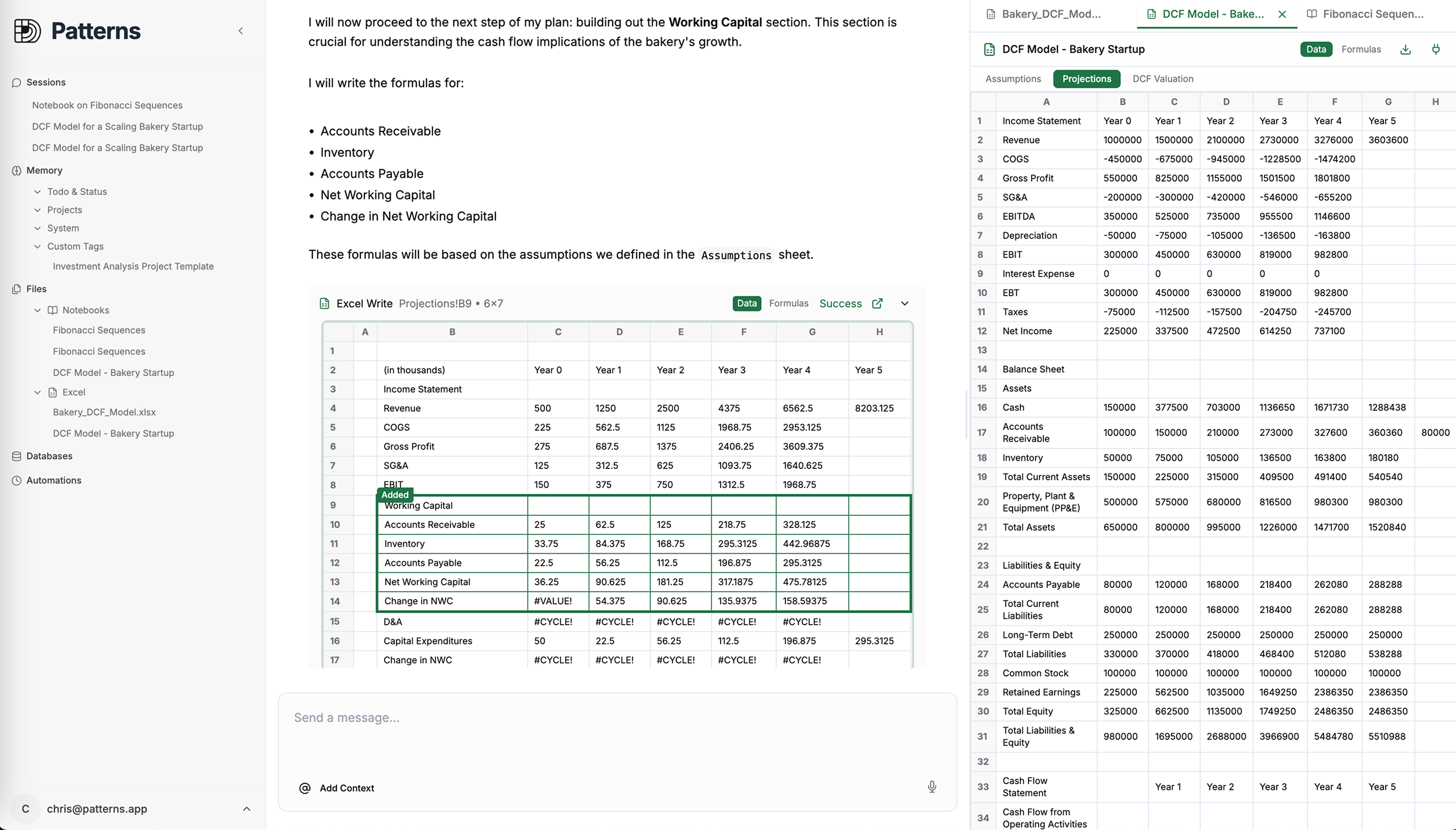

- • Financial model — drivers‑based revenue; bottoms‑up cost by drivers; sensitivities

- • Customer & operational analytics and KPIs

- • Buyer universe (200+ names) with tags & contacts

- • Dataroom index + diligence request list

Process Intelligence

Turn buyer interactions into actionable intelligence—weekly process memos, Q&A triage, and bidder analytics.

- • Outreach waves & IOI tracker, bidder analytics & heatmaps

- • Take buyer/banker call transcripts → extract insights → weekly process memos

- • Q&A triage and answers (draft responses, coordinate owners)

| Inputs | Outputs | Cadence |

|---|---|---|

| Buyer/banker call transcripts, email threads, Q&A questions | Weekly memo (sentiment, risks, next actions), FAQ/Q&A log, bidder heatmap | Weekly |

How It Works

AI

An agentic research platform built for banker outputs—CIM authoring, buyer tagging, KPI packs—with Excel and PowerPoint write‑back.

Offerings

Pick the path that fits your team—done‑for‑you sprints or software you drive.

- • 60–80 slide CIM draft, drivers‑based model, 200+ buyers

- • Compress 6–8 weeks to 3–4

- • Weekly process memos, Q&A triage, bidder analytics

- • Keep leadership aligned without adding headcount

Outcomes & Capacity

See how agent assistance changes throughput. Adjust the parameters below to understand capacity gained and extra deals you can run with the same team.

Calculator estimates vary by deal scope, templates, and review processes.

Traditional vs Agentic (Sell‑Side)

See the difference between traditional deal execution and our agentic approach.

Infinite scale,

expert validation,

instant impact.

Traditional Deal Team

Patterns: Agentic Deal Execution

Speed to deliverables

Quality & accuracy

Scale & capacity

Cost structure

Speed to deliverables

Quality & accuracy

Scale & capacity

Cost structure

Access & Security

Cloud, private cloud (VPC), or fully air‑gapped on‑prem. Pick the environment that matches your firm’s requirements.

Use leading cloud models (GPT‑4, Claude, Gemini), dedicated private endpoints, or open‑source models for maximum control.

- SOC 2 Type II and ISO 27001 programs

- Encryption in transit and at rest

- SSO/SAML/SCIM, RBAC, least‑privilege

- Customer‑managed keys (Enterprise), data residency options

- Audit logs and environment isolation

- No data retained beyond processing; standard 90‑day retention, configurable on Enterprise

Team

Every M&A deal generates the same grunt work: comp tables, buyer lists, LBO models, IC memos. Junior analysts spend 60-80% of their time on repetitive tasks that could be automated.

We're building the execution agent that eliminates this bottleneck. Patterns handles the heavy lifting so your team can focus on judgment, relationships, and deal-making—the work that actually drives value.

Led by operators who've lived through the late nights building models and know exactly where AI can transform deal execution.

Ex-Investment Banker

What you'll do: Shape our product roadmap by translating real deal execution pain points into AI-powered solutions. Own client relationships with PE/IB teams, design workflows that eliminate grunt work, and ensure our automations actually work in practice.

What we're looking for: 3-7 years at a top-tier bank or PE shop. You've built countless models, know every Excel shortcut, and can spot a bad comp table from across the room. Bonus points if you've automated parts of your workflow or wished you could.

Why you'll love this: Finally build the tools you always wished existed. Work with cutting-edge AI while solving problems you've lived through. Help other analysts escape the 3am model-building grind.

AI Engineer

What you'll do: Build production AI systems that handle real financial data and generate analyst-grade deliverables. Design LLM workflows for document extraction, financial modeling, and research automation. Own the technical architecture that makes AI reliable for high-stakes decisions.

What we're looking for: Strong Python/ML background with production LLM experience. You understand both the power and limitations of current AI models. Experience with financial data, Excel automation, or document processing is a huge plus.

Why you'll love this: Work on AI applications that actually matter—helping smart people escape tedious work. Build systems that handle billions in deal value. Shape the future of how finance teams operate.

Ready to Join?

We're looking for people who've felt the pain of manual deal execution and want to build the solution. If you've ever thought "there has to be a better way," let's talk.

Apply to Join Our TeamHelp us eliminate the grunt work that's holding back every deal team.